These projects face ongoing challenges due to inflation and workforce shortages, despite increased federal funding

Builders and Contractors are experiencing a steady flow of infrastructure projects as federal funding remains available. Nevertheless, the construction industry is facing challenges due to a shortage of workers and high inflation rates. Additionally, spending on transit and fossil fuel projects has declined over the past year.

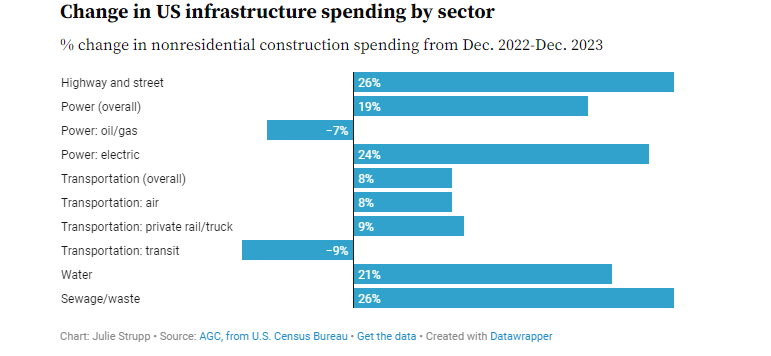

Based on data from the U.S. Census Bureau, construction spending increased by 14% from December 2022 to December 2023, without adjusting for inflation. Nonresidential spending saw a significant rise of 20%, primarily driven by manufacturing projects and infrastructure segments such as roads and waste management.

“It doesn’t seem like anyone is necessarily struggling in terms of activity,” said Associated Builders and Contractors Economist Zachary Fritz. “Our expectation is that we’re going to keep seeing infrastructure spending dollars hitting the ground, and you’re going to see these projects progress.”

zachary fritz

Infrastructure projects have seen a boost not only from federal funding but also from a robust economy overall, according to Ken Simonson, the chief economist at the Associated General Contractors of America. The combination of federal pandemic relief and strong local government budgets has propelled these projects forward.

“Even though the money wasn’t earmarked for construction, it allowed governments with balanced-budget requirements to avoid cutbacks,” Simonson said.

In 2023, while the majority of infrastructure projects experienced growth, there was a decline in spending for oil and gas projects as well as transit projects. These sectors encountered unique challenges.

The financing for fossil fuel projects has become increasingly difficult as banks have scaled back their involvement in the industry. Additionally, the COVID-19 pandemic has led to a decrease in ridership and revenues for transit systems, resulting in a delay in subway and light rail construction. Alison Black, the senior vice president and chief economist at the American Road and Transportation Builders Association, noted that there has been some delay in these projects. However, there has been an increase in work being done on station terminals and Amtrak Class 1 railroads.

According to AGC’s 2024 Outlook, nearly 70% of respondents foresee expanding their workforce in the next year, but over half anticipate difficulties in recruitment. Simonson highlighted ongoing struggles for contractors in staffing their projects, leading to delays.

“Labor costs are rising, and projects may face delays if there’s a shortage of essential workers,” he explained. “Some projects have been halted, downscaled, or prolonged due to critical labor shortages.”

kim simonson

Material shortages, particularly in electrical equipment like switchgear transformers, have also impeded progress, Simonson noted. Despite some moderation in material prices, inflation remains a concern.

“While certain material prices have stabilized, pressure persists on various commodities,” added Black. “We’re not completely out of the woods yet.”

alison black

Additionally, regulatory and judicial review processes are creating hurdles for the release of federal funds for projects. Simonson cited challenges with Build America and Buy America regulations, which mandate domestic production for certain materials on federal projects, causing delays in obtaining waivers.

“Some sectors are poised for growth,” observed Fritz, noting increased activity in water, sewage, waste disposal projects, and upcoming public power initiatives anticipated in 2024. He emphasized that power projects often face lengthy planning phases and are susceptible to delays.

As transit agencies grapple with pandemic-related challenges, Marsia Geldert-Murphey, President of the American Society of Civil Engineers, highlights the increasing focus on resilience and sustainability in infrastructure projects. She notes that historically underfunded areas like passenger rail and light rail are now progressing, with significant investments driving projects forward.

Moreover, Geldert-Murphey observes heightened activity in ports, inland waterways, and bridge projects, buoyed by the $40 billion allocation from the IIJA. Major initiatives such as the Brent Spence Bridge in Ohio and Kentucky, along with the Hudson River Tunnel in New York, are now receiving the necessary funding to commence construction.

SOURCE: U.S. Census Bureau & AGC