Exxon Mobil Corporation announced on Wednesday, during an event held at its headquarters in northern Houston, that the demand for its refineries will persist even as gasoline demand diminishes. The company unveiled detailed plans to produce new products at its refineries in response to the decreasing value of petroleum-based transportation fuels and the increasing need for alternative products. One such product is a new polymer derived from gasoline, which Exxon claims is exceptionally strong and durable, capable of replacing steel rebar at a significantly reduced weight.

Exxon presented this steel replacement as an example of its strategy to repurpose low-value molecules in innovative and potentially lucrative ways, particularly as the fight against climate change gains momentum. The company aims to triple the earnings of its refining and chemicals segment by 2027, compared to a baseline set in 2019. According to Jack Williams, Exxon’s senior vice president, the company has already made significant progress towards this goal.

“The products that we’ll generate will change. Refining is not going to go away,” Williams said. “We’re still going to need these products. A lot of them are going to be feeding chemicals.”

Williams emphasized that while the specific products generated by Exxon’s refineries may change, the need for refining itself will not disappear. He stated that many of the products will be used in the production of chemicals, highlighting the continued importance of refining in the company’s operations.

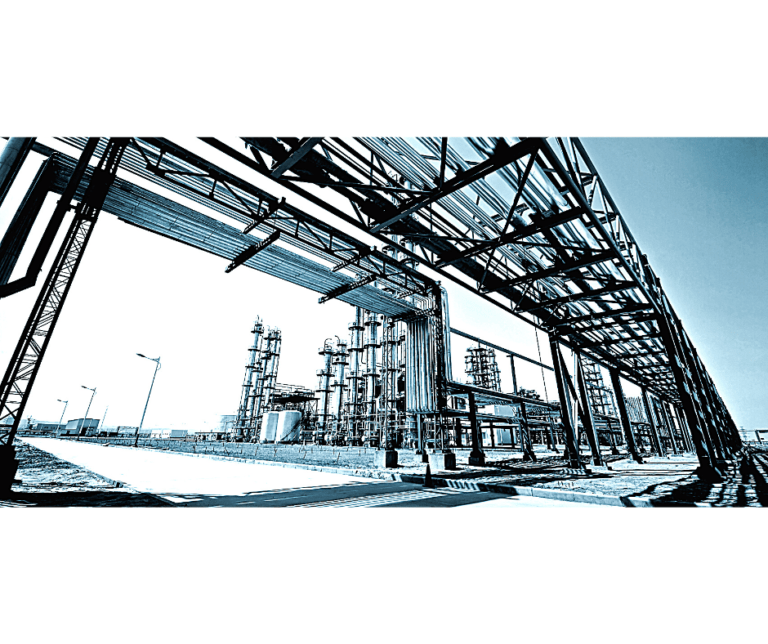

Exxon organized an event at its expansive Spring campus to showcase its plans to adapt to changing consumer demand, particularly as fewer cars rely on gasoline, one of its primary products. The company believes that its integrated refining and chemicals facilities provide a competitive advantage, allowing it to shift away from gasoline and expand its chemicals business.

Andy Lipow, president of Lipow Oil Associates in Houston, noted that Exxon already leads its competitors in terms of the volume of petrochemical product streams originating from its oil refineries. This integration could prove to be highly valuable in the future, as Exxon has the capability to convert materials previously used for gasoline production into the petrochemical market, thereby creating new products. Lipow believes that this strategy will help Exxon maintain its position in the industry as gasoline demand peaks in the United States.

“What Exxon is saying is in an environment where they see gasoline demand peaking in the United States,” he said. “They have the ability to convert some of those materials that have been going into gasoline into the petrochemical market and make new products. It helps them look to the future.”